INSIGHT

ARPA SLFRF Compliance and reporting: Five facts you should know

Connect with us

With the distribution of the American Rescue Plan (ARPA) State and Local Fiscal Recovery Funds (SLFRF), the Treasury released the Compliance and Reporting Guidance. The Guidance provides additional detail and clarification around the reporting, subrecipient monitoring and single audit requirements for SLFRF program funds as well as best practices in fulfilling those responsibilities.

Here are five facts you should know about the Guidance.

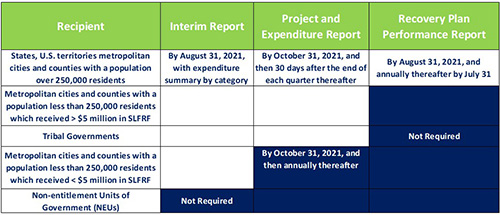

1. Report types and filing deadlines vary based on the type of government entity.

SLFRF fund recipients are categorized into five groups. How the funds can be used is consistent across the groups, however reporting requirement vary by the type and amount of funds received.

- Interim Report: Provides initial overview of status and uses of funding. This is a one-time report.

- Project and Expenditure Report: Report on projects funded, expenditures, and contracts and subawards more than $50,000, and other information.

- Recovery Plan Performance Report: Information on the projects that large recipients are undertaking with program funding and how they plan to ensure program outcomes are achieved in an effective, efficient, and equitable manner.

Reporting requirements by recipient type.

See the ARPA FAQs for more details about eligible projects and when funds need to be spent by to comply with the SLFRF guidelines.

Non-entitlement Units (NEUs) - Requesting funds

NEUs must request their SLFRF funds from their respective states. Each state has its own process and requirements, however basic information that every NEU should expect to provide when requesting funding is consistent.

2. Recipients planning to use SLFRF funds in combination with other funding sources should be mindful of any additional compliance obligations that may apply.

There are no matching, level of effort or earmarking compliance responsibilities associated with the SLFRF award. However, using the funds in combination with other funding might impose additional restrictions or regulations, especially for water, wastewater and broadband infrastructure projects. To help ensure there are no issues, it will be important to maintain proper documentation of expenditures and the applicable compliance requirements.

3. SLFRF recipients are required to manage and monitor their subrecipients to ensure compliance with the requirements of the SLFRF.

Recipients are responsible for oversight of any subrecipients of SLFRF funds which includes ensuring compliance with the SLFRF statute, SLFRF Award Terms and Recipients, and if applicable the subrecipient(s) administering a program on behalf of an organization, will need to do the following items as part of subrecipient monitoring.

- Maintain procedures to ensure subrecipient or contractor’s eligibility.

- Maintain records of all award agreements identifying or otherwise documenting subrecipients’ compliance obligations.

- Perform a risk assessment to evaluate each subrecipient’s risk of noncompliance. This may include factors such as prior experience in managing Federal funds, previous audits, personnel and policies or procedures for award performance monitoring.

- Clearly identify to subrecipients that the award is a subaward of SLFRF funds as well as the compliance and reporting requirements for the of use of SLFRF funds.

- Monitor subrecipient compliance, identify any deficiencies and follow-up to ensure any deficiencies have been resolved.

- Provide project information in the Project and Expenditure Report for each contract, grant, loan, transfer or direct payment greater than or equal to $50,000. For payments less than $50,000, aggregate reporting is required and will be accounted for by expenditure category at the project level.

Single Audits

Recipients and not-for-profit subrecipients that expend more than $750,000 in Federal awards during their fiscal year will be subject to an audit under the Single Audit Act and the 2 CFR Part 200, Subpart F. For-profit entities that receive SLFRF subawards are not subject to Single Audit requirements, however, they are subject to other audits as deemed necessary by other governmental entities.

4. Infrastructure projects have additional reporting requirements.

For projects listed under the water, sewer and broadband expenditure, detailed project information will be required on the Project and Expenditure Report.

- Projected/actual construction start date (month/year)

- Projected/actual initiation of operations date (month/year)

- Location (for broadband, geospatial location data)

- For projects more than $10 million, workforce practices report

- Certification of paid wages at rates in accordance with the Davis-Bacon Act or a project employment and local impact report.

- Certification a project includes a labor agreement or a workforce plan.

- Whether the project prioritizes local hires.

- Whether the project has a Community Benefit Agreement, with a description of any such agreement.

Water and sewer projects will require either a National Pollutant Discharge Elimination System (NPDES) Permit Number for projects that aligns with the Clean Water State Revolving Fund (CWSRF) or a Public Water System (PWS) ID number if the project aligns with the Drinking Water State Revolving Fund (DWSRF).

Broadband projects will require details on the speeds/pricing tiers, technology to be deployed, miles of fiber, cost per mile, cost per passing and the number of households, institutions and businesses.

Procurement Requirements

Recipients must conduct and document procurement transactions in a manner providing full and open competition, consistent with standards outlined in 2 CFR 200.317 through 2 CFR 200.320. Non-Federal entities may use a qualifications-based competitive proposal process for architectural/engineering (A/E) professional services.

5. Funds can be used to help cover the administrative burden of the SLFRF.

Managing the reporting requirements could become an administrative burden, especially for local governments that do not have dedicated staffing for grant management. To help with this issue, recipients may use SLFRF funds to help pay for administering the program. This includes the costs of consultants.

Additional Resources

If you have questions about a specific project and if it qualifies under the SLFRF program or if you need assistance with reporting requirements or identifying potential projects including wastewater, water, ventilation improvements or public building designs to help mitigate COVID, contact our funding specialist Steve Schultz or fill out the form below.

PROJECT EXAMPLES

Wastewater UV disinfection reduces energy consumption and increases flow capacity

HVAC Improvements to Address COVID Guidelines

Solution for Social Distancing in Classrooms

HELPFUL LINKS FROM THE U.S. TREASURY

Compliance and reporting guidelines for all recipients

NEU guidance and helpful links

Report responsibilities including outlines and examples:

Counties/Cities with population over than 250,000 and awards over $5M

Counties/Cities with population less than 250,000 and awards over $5M

Counties/Cities with population less than 250,000 and awards under $5M

Tribal Governments

Tell us about your project

We’d love to work with you. Tell us the services you are seeking and one of our team members will connect with you.